7 Simple Techniques For Fortitude Financial Group

7 Simple Techniques For Fortitude Financial Group

Blog Article

Some Of Fortitude Financial Group

Table of ContentsAbout Fortitude Financial GroupThe Basic Principles Of Fortitude Financial Group Fortitude Financial Group - An OverviewSome Known Facts About Fortitude Financial Group.Examine This Report about Fortitude Financial Group

Note that several advisors will not handle your properties unless you satisfy their minimal demands (Financial Resources in St. Petersburg). This number can be as low as $25,000, or reach into the millions for the most exclusive consultants. When picking a monetary expert, discover if the individual follows the fiduciary or suitability requirement. As kept in mind previously, the SEC holds all advisors registered with the company to a fiduciary standard.The broad field of robos covers platforms with access to financial consultants and investment management. If you're comfy with an all-digital platform, Wealthfront is an additional robo-advisor option.

You can find a financial advisor to aid with any kind of facet of your financial life. Financial advisors may run their very own firm or they may be part of a larger workplace or bank. Regardless, a consultant can aid you with every little thing from building a financial strategy to investing your money.

The Single Strategy To Use For Fortitude Financial Group

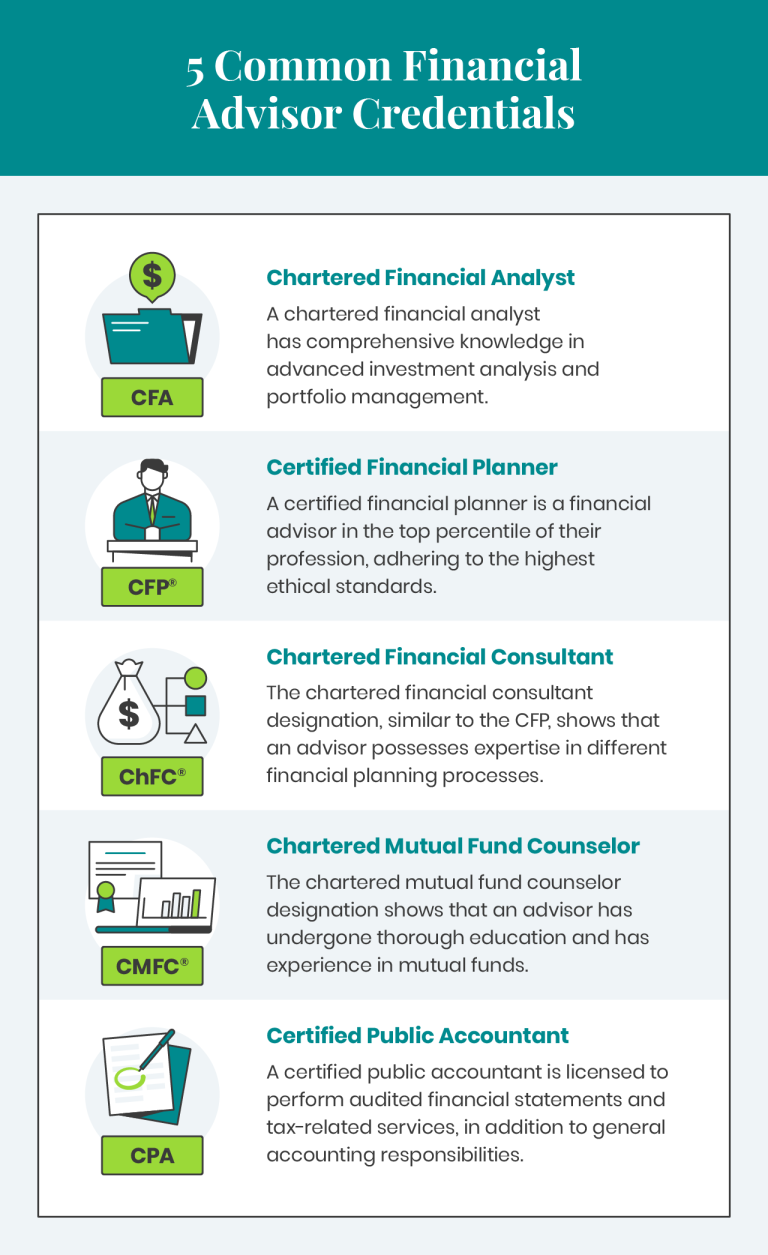

Think about functioning with a economic advisor as you produce or change your monetary strategy. Locating an economic consultant doesn't need to be tough. SmartAsset's free tool matches you with approximately three vetted monetary consultants who serve your area, and you can have a complimentary initial telephone call with your consultant matches to determine which one you feel is best for you. See to it you ask the appropriate inquiries of anyone you take into consideration working with as a monetary consultant. Inspect that their qualifications and abilities match the solutions you desire out of your advisor - https://sketchfab.com/fortitudefg. Do you desire to find out more about economic experts? Check out these short articles: SmartAsset adheres to an extensive and in-depth Content Plan, that covers principles bordering precision, trustworthiness, content self-reliance, knowledge and objectivity.

The majority of people have some psychological connection to their cash or the important things they get with it. This psychological link can be a primary reason that we might make inadequate monetary choices. A professional economic advisor takes the feeling out of the equation by giving objective guidance based upon knowledge and training.

As you undergo life, there are monetary decisions you will certainly make that might be made extra easily with the guidance of a specialist. Whether you are attempting to reduce your financial obligation lots or want to begin preparing for some long-lasting objectives, you could take advantage of the services of a monetary advisor.

The Single Strategy To Use For Fortitude Financial Group

The fundamentals of investment monitoring consist of acquiring and offering economic possessions and various other investments, yet it is moreover. Managing your financial investments entails understanding your short- and long-term goals and utilizing that information to make thoughtful investing decisions. An economic advisor can provide the information essential to assist you diversify your investment profile to match your wanted level of danger and fulfill your financial objectives.

Budgeting provides you an overview to just how much cash you can spend and just how much you must save every month. Adhering to a budget will aid you reach your short- and lasting financial objectives. A financial advisor can help you detail the activity steps to require to establish and keep a budget plan that works for you.

In some cases a clinical bill or home repair service can suddenly include to your debt load. A professional financial debt administration plan assists you settle that financial debt in one of the most monetarily beneficial method feasible. A financial consultant can assist you assess your his explanation financial obligation, prioritize a financial obligation repayment technique, supply options for financial debt restructuring, and describe an all natural strategy to much better manage financial debt and fulfill your future financial objectives.

What Does Fortitude Financial Group Mean?

Personal capital analysis can tell you when you can pay for to purchase a brand-new vehicle or just how much money you can include in your savings monthly without running short for needed costs (Financial Services in St. Petersburg, FL). An economic consultant can assist you clearly see where you invest your money and after that apply that understanding to aid you understand your economic health and just how to boost it

Threat administration solutions determine potential threats to your home, your lorry, and your household, and they help you put the best insurance coverage in location to alleviate those risks. A monetary expert can assist you establish a strategy to shield your gaining power and lower losses when unforeseen points take place.

Some Ideas on Fortitude Financial Group You Need To Know

Reducing your tax obligations leaves more money to contribute to your investments. Financial Services in St. Petersburg, FL. A monetary expert can assist you make use of charitable providing and investment strategies to reduce the amount you have to pay in tax obligations, and they can reveal you how to withdraw your cash in retired life in a manner that additionally lessens your tax burden

Even if you really did not begin early, college planning can aid you place your child via university without facing suddenly large expenditures. A financial consultant can assist you in recognizing the most effective means to save for future college prices and just how to money potential gaps, discuss exactly how to decrease out-of-pocket college expenses, and suggest you on qualification for monetary help and grants.

Report this page